Exploring the crucial time for Japanese suppliers amidst supply chain disruptions, EV transformation, and strategic mergers.

Japanese manufacturing is living in a very exciting and critical time. There were three years of supply chain disruptions due to the coronavirus pandemic. There is ongoing tension between the United States and China. As such, we are seeing multinationals worldwide looking to diversify their suppliers with a focus on reliability. Here enters a country like Japan, known for decades for having advanced technology, high quality, and a trustworthy and reliable business partner. With the severely depreciated Yen, Japan has become incredibly cost-competitive. Do you agree with the premise that this is a critical time for Japanese suppliers? Precision Forging Products

I agree that there is a growing opportunity for Japanese companies. However, I rarely consider that in our daily business operation because we do not directly deal with overseas exports. I suppose that the company whom you interviewed in the same steel processing business might have a similar view to us. Our direct customers are domestic. We provide raw materials and parts to manufacturers in Japan, who then export their finished products or parts overseas. We now feel that there is a growing need for our customer's products.

How is the return of domestic manufacturing impacting your day-to-day operations?

Your clients must be struggling to recruit experienced personnel who understand what to do with the raw materials that you provide. Can you give us some insight into how this trend affects your business?

We are seeing a general return of manufacturing in Japan. However, companies went overseas in the automotive industry due to the need for local production. As a result, parts manufacturers also went overseas to have a local production site and provide the same quality products and services as Japan. I do not see automotive part manufacturers returning to Japan in this situation. For example, the North American market has limited production due to a lack of labor force, so Japan compensates for this shortage. Japan is producing more to export to the North American automotive market.

Do you have challenges in your recruitment activities or preserving the company’s expertise? If so, how are you dealing with the hurdles an aging society presents?

Regarding recruitment, we are extending the retirement age from 60 to 65 to compensate for the lack of a labor force. Workers with experience willing to work can remain with the company longer. We are providing adequate welfare within the company to acquire attractive human resources. For example, we established a headquarters in Hanno three years ago and have a canteen to provide attractive meals to workers.

Your products go to the part makers and then passed on to the automotive manufacturers. This sector is living a transformative time with the switch to EV. Where does your product end up? The number of parts that go into an EV engine or hybrid is vastly fewer than that of an ICE (internal combustion engine) typical engine. How is this change impacting your business, and how are you responding to this challenge?

Shifting to a 100% EV battery has a negative impact on us since most of our steel material is currently used for engines and transmissions, which will be replaced with E-axels, so the amount of steel per automotive that our company provides would decrease. On the other hand, there would be an increased demand for body fasteners, bolts, brakes, and steering components. Using lighter and stronger materials would be required to compensate for the battery’s heavy weight. With a 100% conversion to EV, the demand volume for our current products will decrease, but there will also be an increased demand for other parts for us.

From Japanese manufacturers' point of view, we will not be seeing a 100% EV drastically. We foresee a gradual shift from ICE to Hybrid to EV. Our product demand will not see a sharp drop but a gradual change. Different companies have different perspectives. One of our customers in forging parts is increasing their investment although the global market trend is expected to decrease because they still expect a growing demand for the time being. On the other hand, companies like Nippon Denso are selling their spark plug section to get out of the ICE business.

Automotive had been your main focus for most of your history. You also have different kinds of industrial machinery and certain kinds of construction machinery or materials. There is still a demand for steel. For example, mining machinery or machinery that offers 24/7 with no time to charge cannot be switched to EV the same way. Are you pursuing other industries or applications for your products?

We are focusing on small-sized construction machinery and increasing our share in hydraulic shafts. However, in the construction industry, the steel material used does not always have to be of high quality and reliability, so our products may not be appealing to the industry in terms of price competitiveness. An example of our products that we have competitiveness is a brake part. We supply precise parts that are forged instead of cut. As opposed to shaving, which has to throw away some of the material, we do not waste much material in our process, so it is eco-friendly.

Our clients must be those who can appreciate the goodness of our forged products. Making general purpose products for construction equipment is not our target. We aim to provide materials for safety-critical components such as the hydraulic shaft for small-scale construction machinery. The shaft must not break or have any oil leakage. Areas that require sensitivity and quality are the areas of our expertise.

The downside of our product is that it cannot sustain long-distance transportation. Even small scratches on the surface will lead to the breakage of the forging. The material is vulnerable during transportation. However, once processed into parts, the surface gets stronger for exports. This is why our business model is provided to domestic companies, who then make the parts to export.

Earlier, you mentioned that your business model is focused on Japan for many reasons. Part makers went overseas less for cost competitiveness and more about directly supplying high-quality materials and parts to the automakers. You do not expect them to be coming back to Japan anytime soon. Do you find yourself in a unique position as part of the Nippon Steel Group to take advantage of a diverse and robust international network? What kind of infrastructure do you have in place if a client in Japan requests your material for an overseas site? How are you able to accommodate such requests?

There is not much demand in exporting our products to overseas production bases. Of course, if our customer request it we can provide the service and package the material securely to prevent surface scratches. According to our customers’ requests we can adequately package it for export. However, we do not see this as the core business we must pursue. The sophisticated forging technology and production of parts are mainly done in Japan. Most non-Japanese local companies do not utilize the forging technology. They use the shaving and cutting method, which does not require high-quality material like ours. That is the reason why I am saying there is no demand overseas.

Your clients come from areas that appreciate this level of quality and the potential this material can have for their manufacturing. Another consequence of Japan's shrinking population is that the market is also inevitably shrinking. Are you interested in connecting with manufacturers with this kind of appreciation, such as Germany, other parts of Mainland Europe, and the United States?

We are not trying to expand overseas because we have not found any existing market in North America or Europe. Although some companies process sophisticated precision parts, their production method differs from the Japanese forging method, so our products are not applicable in their market.

If our customers in Japan are taking their production overseas, we figure out a way to export and deliver our products and raw materials to their factories, mainly near Japan, not in Europe nor North America.

In October, the announcement of the new green company merger is taking place. Can you walk us through the motivation for this activity and your expectations on how it will change the business?

The three companies merging in October are the consolidated companies of Nippon Steel. The businesses are similar in special steel manufacturing and processing. The three merging companies have been located in different areas in Japan and had conducted a similar business using the material of Nippon Steel. Matsubishi Metal Industry Co., Ltd is in East Japan, and Nippon Steel Wire Rods Processing Co., Ltd and Nippon Steel Wire Co., Ltd are in mid-central to western Japan. Having companies in the locality is advantageous since long-distance travel is not good for the products. It had been an efficient system to procure material from Nippon Steel, do the processing, and provide to the companies producing in each local area. However, we had decided to merge three companies because we pursue more efficient business all over Japan. Additionally, thinking about the future, it is apparent that we need to take a new approach towards EV and aim for a carbon-neutral society. A company based only on the locality is not good enough to tackle these issues. Each company has about JPY 20 billion turnover. Nippon Steel Group needed to strengthen itself to tackle overarching issues. By merging the three companies, we can provide a holistic solution in one process and take care of the upstream all the way to the downstream.

With the switch to EV, you mentioned that other areas, like the brakes, different seat parts, and other auxiliary areas, will still need steel. To be more carbon-neutral friendly and lessen the car's weight, automakers and component makers adopt new materials like magnesium, titanium, and aluminum to replace heavy ferrous steel and iron. How are you reacting to this influx of new materials into the sector? Do you have plans to experiment with or adapt these new materials and process them as new alternative businesses or apply this craft process to different metals in the future?

The parts and components that we provide the material to are the safety-critical interior

parts for automotive. For example, exterior parts like the bonnet and the roof are easily replaceable with aluminum for lighter weight. However, safety-critical components require severe safety and quality, so the need for steel components and parts for brakes, steering, and other driving gears will not diminish. It is not an area where it can be easily replaced because of cost or weight reasons. Nobody knows what will happen in the future. Currently, car manufacturers are very careful in changing the materials or the design of the safety critical components, as exemplified by the accident in Toyota in the US. Changing a safety-critical component needs a time-consuming durability test. Auto manufacturers have to consider carefully even if it is advantageous for them to make changes in design or apply new materials.

Your company will be celebrating its 76th anniversary. Imagine we come back four years from now for your 80th anniversary and have this interview all over again. What are your dreams for this company and the new merger, and what goals would you like to accomplish in the coming years?

First and foremost, achieving a successful merger of three companies is the key. Four years may be too short, but it is important to create a good foundation for the newly merged company and to be able to focus on having an integrated and comprehensive service for our customers. I envision being appreciated by our customers for the holistic service that we are able to provide with the merging and establishment of the new company, Nippon Steel Processing Co., Ltd. I want our company to be the go-to company in the industry when there is a need for secondary steel processing. The secondary steel processing field is composed of SMEs in different localities of Japan. This is the first attempt to consolidate nationwide and create a company, Nippon Steel Processing Co., Ltd., that could cover nationwide Japan. We want to be known in Japan and overseas as the company that does that. We are the only consolidated company in the steel processing business of Nippon Steel Group.

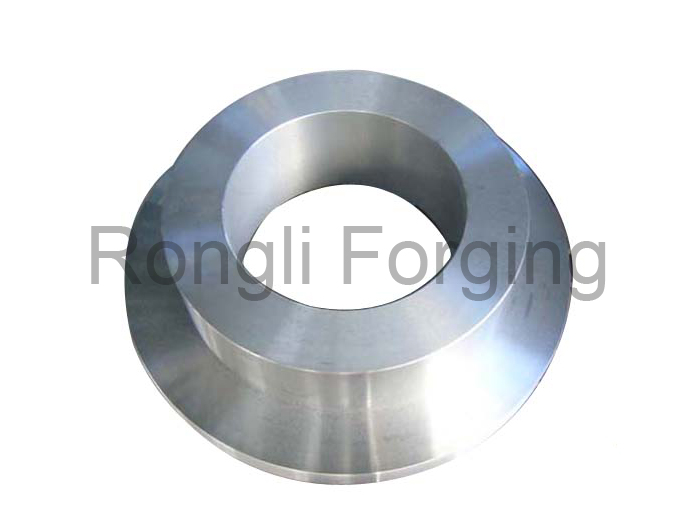

Open Die Forging Cylinder Plunger The Worldfolio provides business, industrial and financial news about global economies, with a focus on understanding them from within.